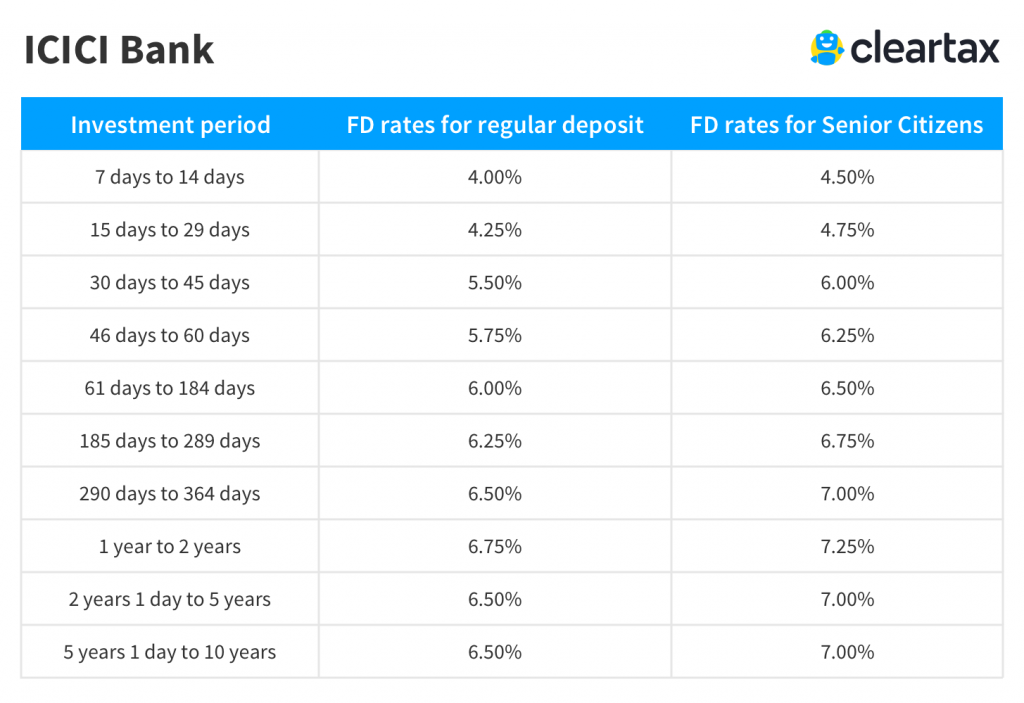

ICICI Bank offers 2.5% interest rate on fixed deposit for maturity period of 7-14 days. ICICI Bank, the country’s second largest private sector bank, currently offers 17 maturity options with varied interest rates on fixed deposits up to Rs 2 crore with an option of pre-mature withdrawal. ICICI Bank, the country's second largest private sector bank, currently offers 17 maturity options with varied interest rates on fixed deposits up to Rs 2 crore with an option of pre-mature.

ICICI BANK UK PLC – We are authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority (Registration Number: 223268).

We are covered by the Financial Services Compensation Scheme (FSCS). The FSCS can pay compensation to depositors if a Bank is unable to meet its financial obligations. Most depositors – including most individuals and businesses – are covered by the scheme.

Icici Fixed Deposit Rates July 2020

In respect of deposits, from 30 January 2017, an eligible depositor is entitled to claim up to £85,000. For joint accounts each account holder is treated as having a claim in respect of their share so, for a joint account held by two eligible depositors, the maximum amount that could be claimed would be £85,000 each (making a total of £170,000). The £85,000 limit relates to the combined amount in all the eligible depositor’s accounts with us including their share of any joint account, and not to each separate account.

Icici Bank Fd

For further information about the compensation provided by the FSCS (including the amounts covered and eligibility to claim) please ask at your local branch, refer to the FSCS website or call the FSCS on 0800 678 1100 or 020 7741 4100. Please note only compensation related queries should be directed to the FSCS.